BofA Says It Knows the Place to Be for Top Bond Returns in 2016

Bank of America Corp. says the world’s best bond rally has more life in it.

Russian ruble debt will earn at least 10 percent in 2016, after leading the world in 2015 with returns of more than 25 percent, according to Bank of America strategists led by David Hauner. They’re predicting central bank Governor Elvira Nabiullina will drive fixed-income gains by cutting interest rates 250 basis points through the end of March, catapulting returns to among the top for emerging market nations.

“You have the biggest rate cuts in emerging markets and the biggest decline in inflation next year,” Hauner said by phone from London Thursday. “That together gives you a beautiful bond story.”

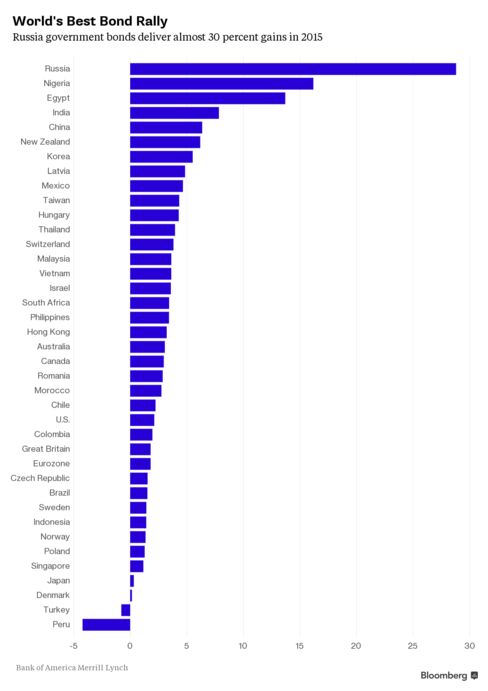

A forecast slowdown in inflation to 7 percent by the end of next year from 15.7 percent will give Nabiullina room to resume loosening policy to lift Russia out of its first recession since 2009. Those who were prepared to stomach the international backlash against Vladimir Putin’s involvement in Ukraine and Syria amid the collapse in oil -- Russia’s biggest export -- earned 29 percent in 2015 on the nation’s bonds, the highest returns in the world, according to a Bank of America Merrill Lynch index of more than 40 governments.

Among those who’ve taken notice are U.S. hedge funds, which are turning up at Russian government bond auctions in increasing numbers, said Ian Hague, a founding partner at New York-based Firebird Management LLC.

‘Even Better’

“It’s a good asset and it’s made even better by the fact that Russia is locked out of other debt markets at the moment,” Hague said by phone Oct. 21. “The normal audience for Russian debt securities has fewer products to focus on. If people are buying the ruble-denominated debt, they are probably also looking at ruble-yielding securities. It puts a bid underneath everything in the market.”

Others say the rally may have run its course. Nomura International Plc has closed out a bet after locking in gains on the one-year swap rate, which fell to 10.6 percent, the lowest since last November.

‘Priced-in’

The "market has already priced in a decent amount of easing for the next 12 month, so we don’t see the risk-reward as attractive,” said Dmitri Petrov, an analyst at Nomura in London.

The Bank of Russia kept rates unchanged last month, the first meeting this year where it hasn’t cut borrowing costs after an emergency increase in December brought the benchmark to 17 percent, crippling the economy in order to restrain accelerating consumer-price growth.

"Sharp disinflation" over the coming months and more stable oil prices into 2016 will allow the Bank of Russia to resume cutting on Oct. 30, when it will lower the key rate to 10.5 percent, and then to 8.5 percent by the end of March, according to Bank of America.

Citigroup Inc. analysts also see a resumption of rate reductions, with Luis Costa writing on Thursday that another 100 basis points of cuts will probably occur by year-end. Costa said the bank was extending the duration of its Russian ruble government bond holdings to seven years from 3.9 years in its benchmark. Duration is a gauge of a bond’s sensitivity to changes in interest rates.

The bank sees the yield on the January 2028 bond falling to between 9.25 percent and 9.5 percent, from 9.9 percent at 7 p.m in Moscow. The securities yielded 9.8 percent earlier Friday, the lowest in a year.

Keine Kommentare:

Kommentar veröffentlichen